Contained Buying for Indices

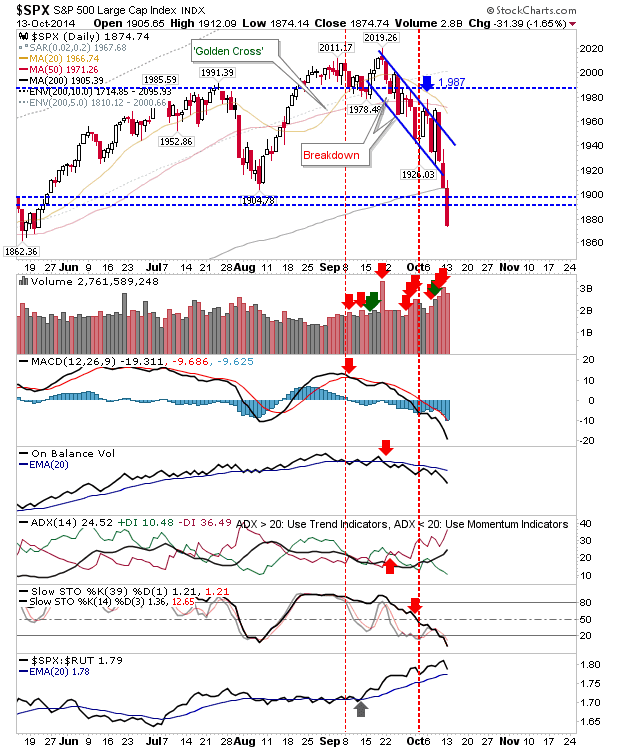

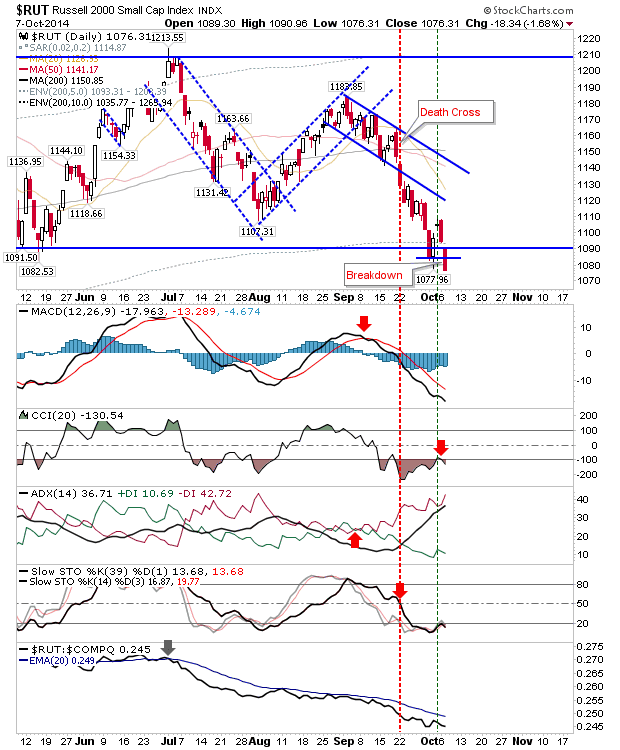

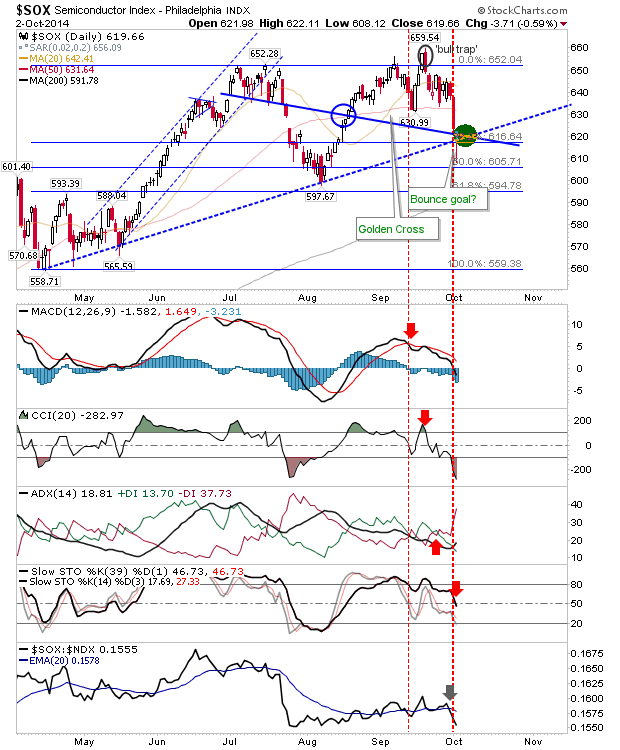

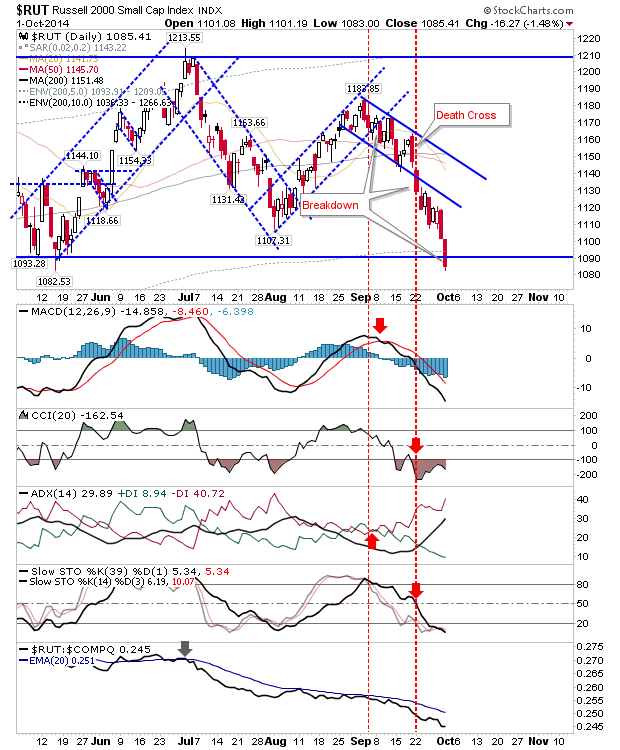

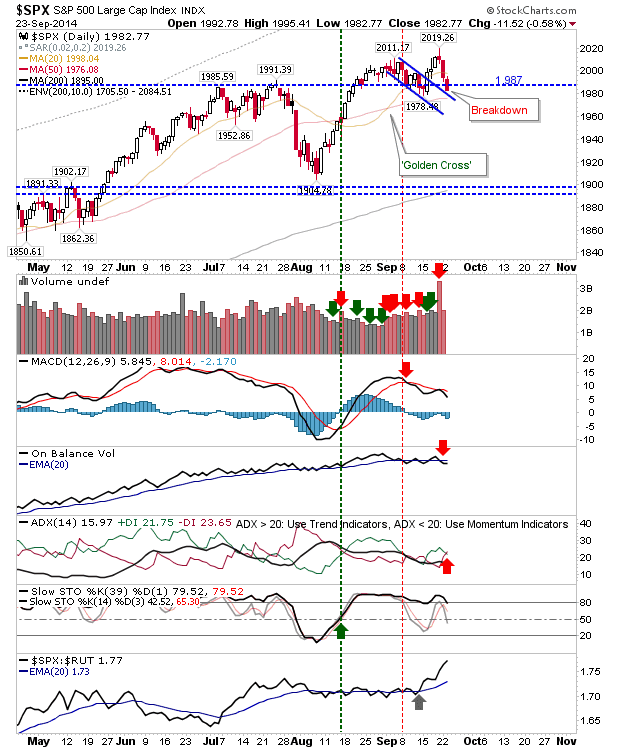

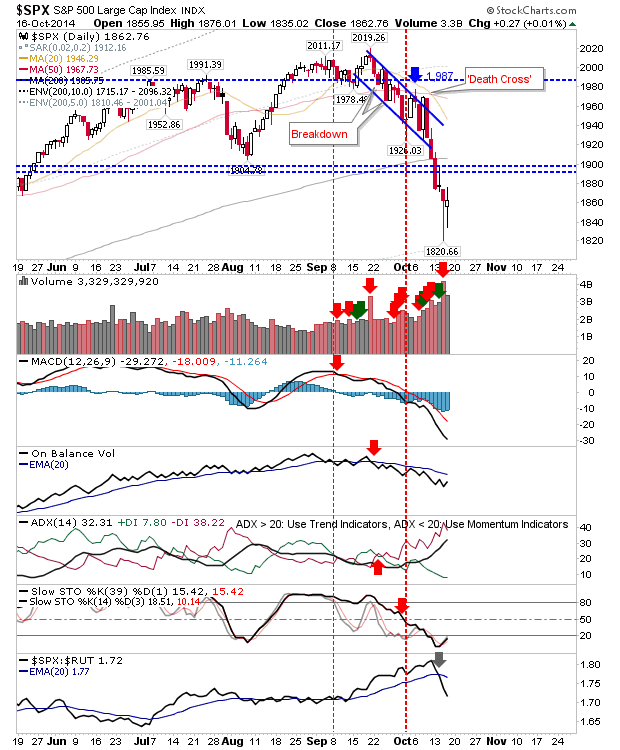

It wasn't the day I expected, but bulls can take some comfort it wasn't worse. Some indices fared better than others. The S&P finished on the bearish side, despite closing a little higher. The inside day to yesterday's wide range day looks like something which will deliver more weakness in the days ahead. A close above yesterday's high would confirm a bottom (maybe not 'the' bottom), but this is something for tomorrow. A 2011 style bottom would still need another 5-6% decline to suggest this.