Daily Market Commentary: Russell 2000 Breakdown

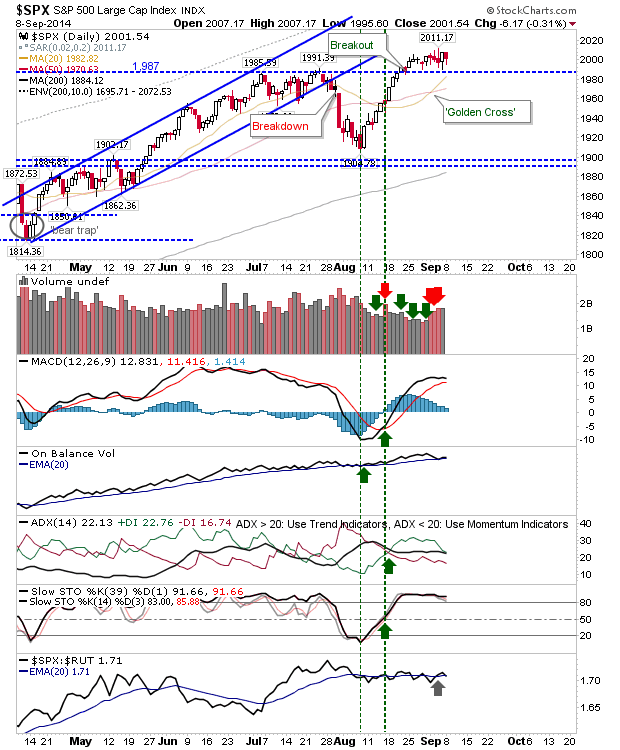

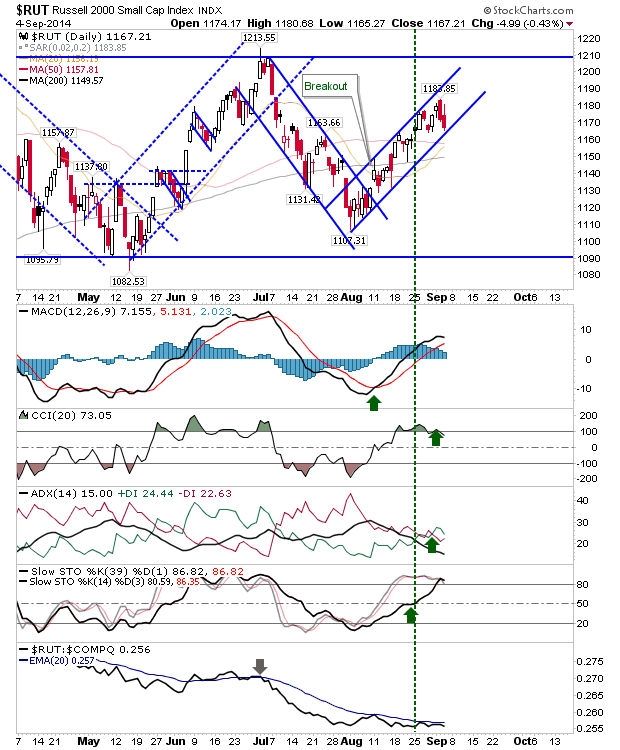

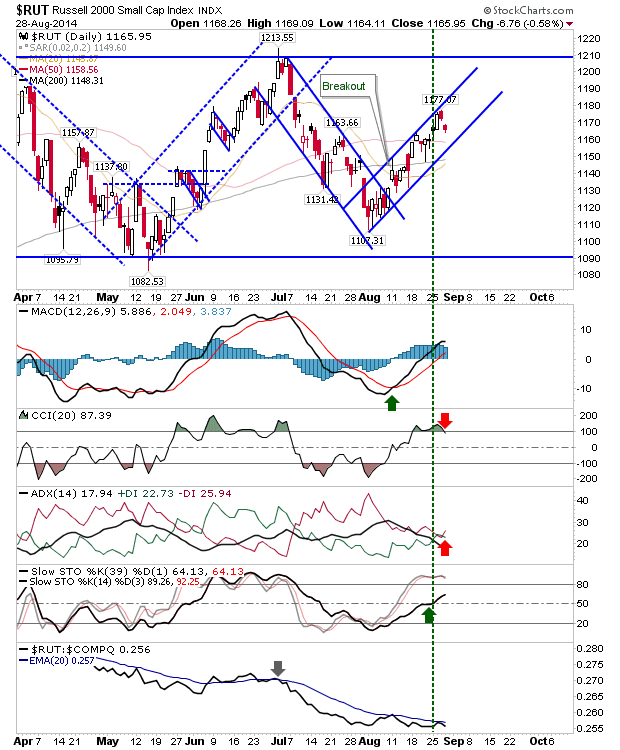

Sellers brought with them volume, but only the Russell 2000 finished the day with a breakdown. The Russell 2000 is trading within a larger, and more significant consolidation, but today's break ends the July-September rally, or at least broadens it. The presence of key moving averages offers additional support to work with, first of which is today's test of the 50-day MA.