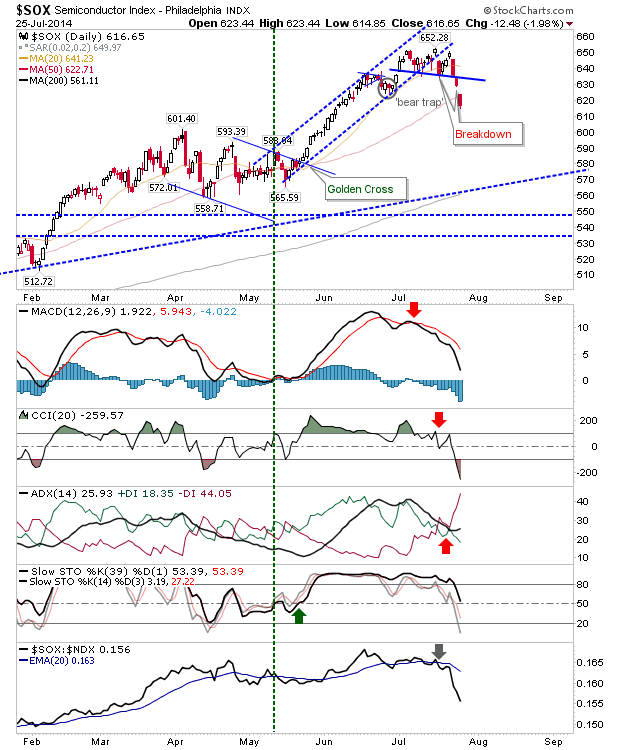

Daily Market Commentary: Semiconductor Gains Accelerate

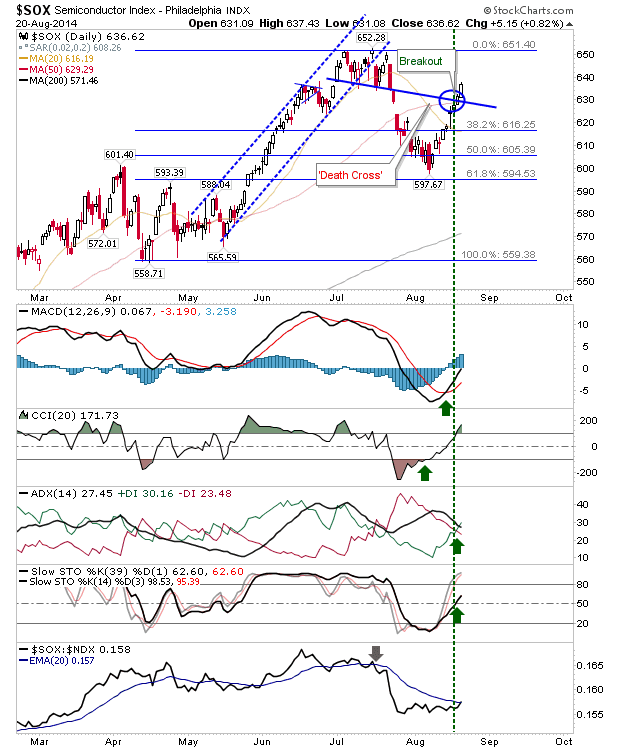

It was more of the same from the Semiconductor index: a solid gain which took the index ever closer to 652 resistance. All of which is helping the Nasdaq and Nasdaq 100 maintain their push to all-time highs. Technicals for the Semiconductor Index are net bullish. Weakness will offer itself as a buying opportunity, particularly at the breakout line and/or 50-day MA. Risk can be measured from the 38.2% fib retracement at $616.25.