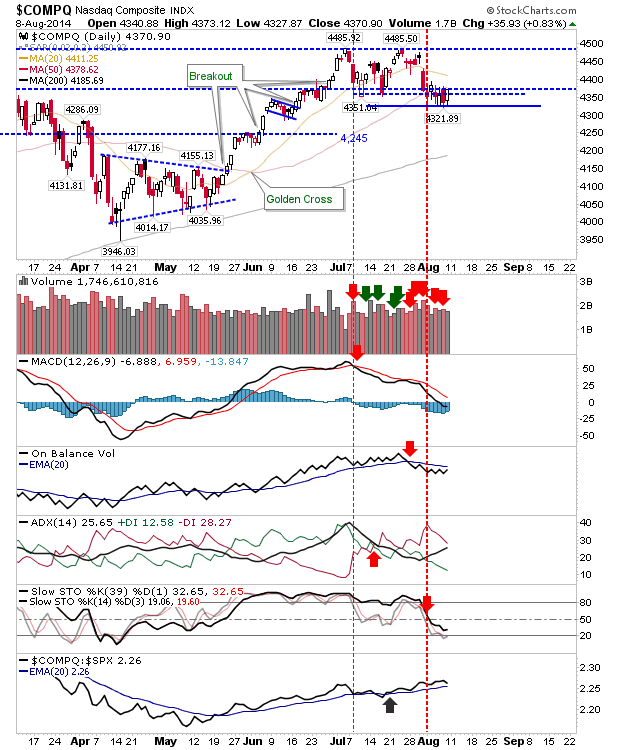

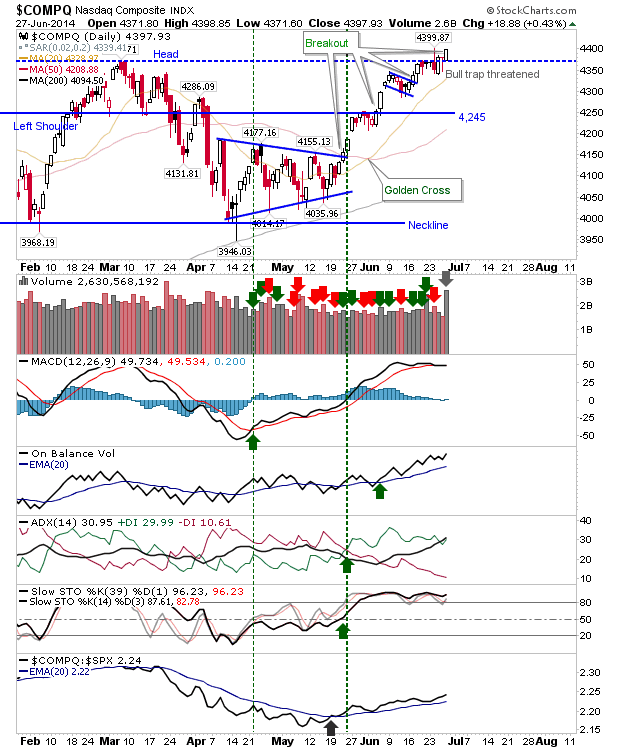

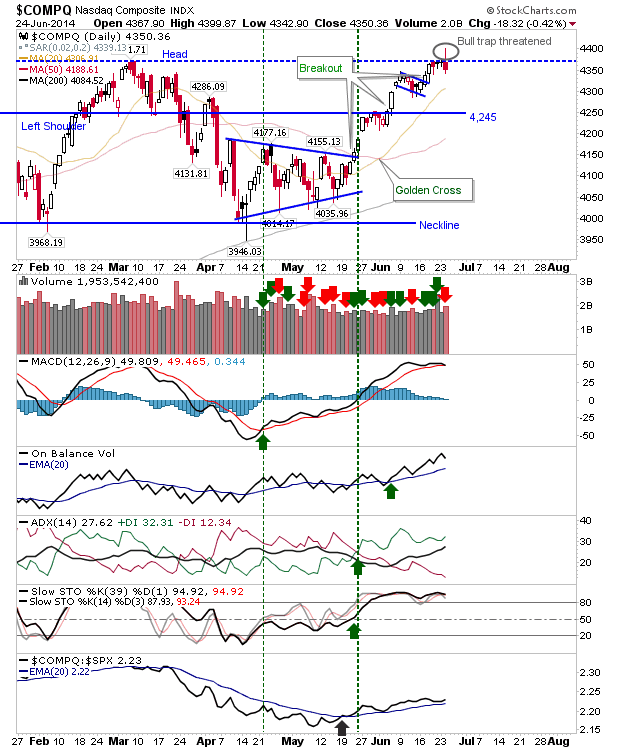

Sellers had to return at some point, and Tuesday was the day they paid a visit. I was too consumed with Suarez's fine dining skills to do an update last night, but given the day ranked as a distribution day it's worth passing comment. The most important action was found in the Nasdaq. The index had looked to comfortably break past resistance, only to see it finish below this resistance. A classic 'bull trap' requires a close above, then below resistance, but Tuesday's action was more a plain rejection of the breakout level as a support zone. The 'inverted hammer' on overbought short and intermediate term stochastics is a possible short entry with a break of 4,342 and an initial stop above 4,400. If going short, look to move the stop to around 4,369 on the first close below 4,342.