Bulls Recover Intraday Losses

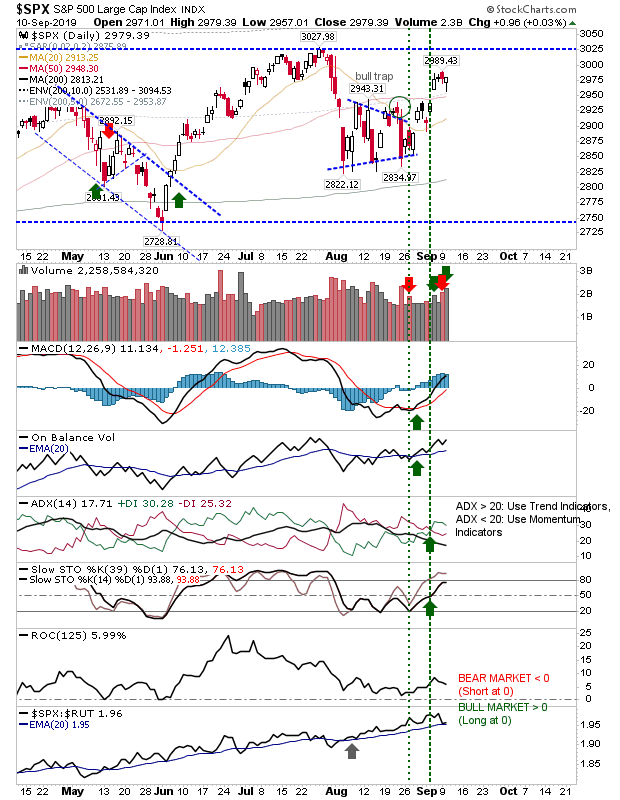

While the indices finished at prices without fanfare, the intraday recovery was very good. The S&P spiked down to its 20-day and 50-day MA with a bullish hammer. Volume climbed to register as accumulation. Technicals remain net bullish although relative performance eased.

The Nasdaq generated a 'hammer' on its 50-day MA. Technicals are more mixed with On-Balance-Volume returning to a 'sell' trigger as part of a downtrend since the start of August is the only negative.

The Russell 2000 closed with an inside day, touching against the 200-day MA. Relative performance ticked above its long standing downward trend since June. The index is moving into a price void with the spike high at 1,600.

The Dow Jones Industrial Average closed near the high of its breakout rally. Volume climbed in accumulation.

Indices didn't much today, but what they did do offers a positive outlook for tomorrow.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Nasdaq generated a 'hammer' on its 50-day MA. Technicals are more mixed with On-Balance-Volume returning to a 'sell' trigger as part of a downtrend since the start of August is the only negative.

The Russell 2000 closed with an inside day, touching against the 200-day MA. Relative performance ticked above its long standing downward trend since June. The index is moving into a price void with the spike high at 1,600.

The Dow Jones Industrial Average closed near the high of its breakout rally. Volume climbed in accumulation.

Indices didn't much today, but what they did do offers a positive outlook for tomorrow.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.