Dow Struggles Continue as Tech Breakouts Hold

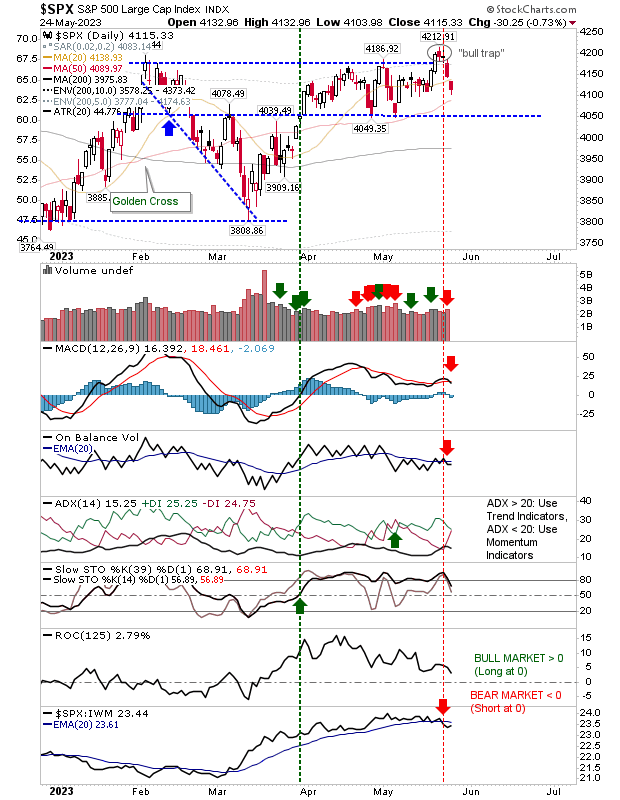

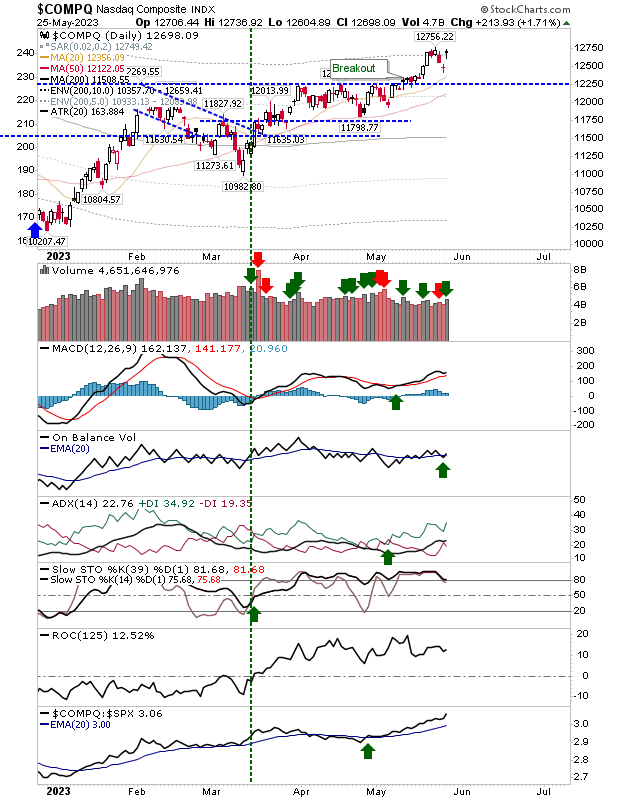

There wasn't a whole lot going on today which was different to Friday. Breakouts in the Nasdaq, Nasdaq 100 and Semiconductor Index remain in effect while the Dow Jones Industrial average took an early hit in profit taking but on lighter volume. Relative performance remains particularly ugly.

The Semiconductor Index, Nasdaq and Nasdaq 100 all finished with a spinning doji which maintained the status quo without threatening the breakouts.

The Russell 2000 performed well as it looks to make it back to the last swing high. There is plenty of wiggle room to protect the break of the February swing high.

For tomorrow, traders will be looking for more of the same. Shorts can probably get more aggressive with the Dow but wannabe longs will need to wait for a pullback in Tech indices to get their opportunity.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Semiconductor Index, Nasdaq and Nasdaq 100 all finished with a spinning doji which maintained the status quo without threatening the breakouts.

The Russell 2000 performed well as it looks to make it back to the last swing high. There is plenty of wiggle room to protect the break of the February swing high.

For tomorrow, traders will be looking for more of the same. Shorts can probably get more aggressive with the Dow but wannabe longs will need to wait for a pullback in Tech indices to get their opportunity.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

. I invest in my pension fund as a buy-and-hold.