Another Acceleration in the Rally

Another day of gains pushed Indices to new highs and offered a breakout from the accelerated channel for the Nasdaq but it was the Russell 2000 which took the biscuit.

The Russell 2000 added nearly 2% as buyers swooped in to take advantage of recent quiet action. This follow on to the recent breakout sits the index up nicely for further gains.

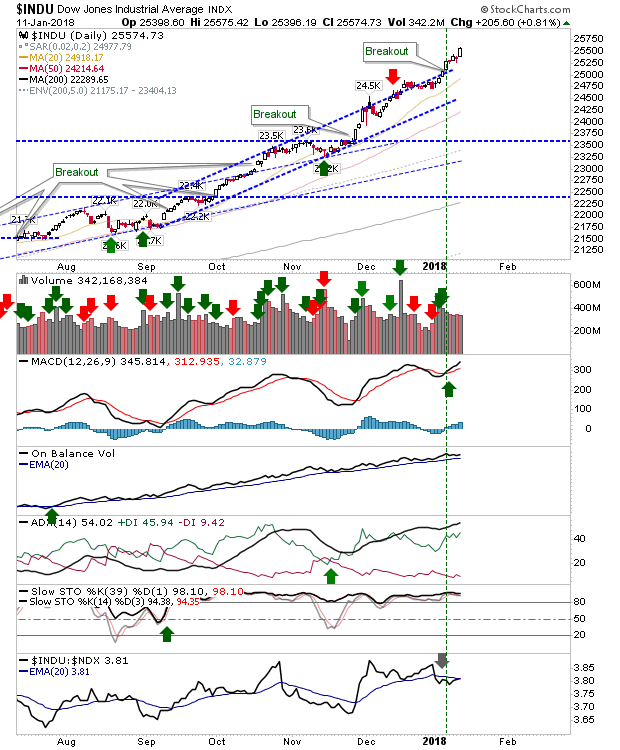

The pick up in pace for the rally is probably most noticeable in the Dow. The mid-December tag of channel resistance (which was a 'sell' / shorting opportunity) is looking very distant now.

A similar acceleration is taking place in the S&P although there is a new channel resistance hit for sellers/shorts to cling on too. The sharp drop in relative performance against the Russell 2000 may further signify a shift in money rotation back towards more speculative stocks (and away from the S&P).

The Nasdaq looks to be following the lead of Large Caps as it steps outside of its current channel in yet another shift in acceleration. The index still enjoys good technical strength support so sellers/shorts haven't much to work with.

However, the sister index, the Nasdaq 100, could instead be offering shorts a chance to take advantage of this speculative shift in the rate of buying.

For tomorrow, continue to monitor index activity at channel resistance. Any selling which returns an index below channel resistance leaves it open to a potent 'bull trap' and could be a decent - if aggressive - shorting opportunity.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Russell 2000 added nearly 2% as buyers swooped in to take advantage of recent quiet action. This follow on to the recent breakout sits the index up nicely for further gains.

The pick up in pace for the rally is probably most noticeable in the Dow. The mid-December tag of channel resistance (which was a 'sell' / shorting opportunity) is looking very distant now.

A similar acceleration is taking place in the S&P although there is a new channel resistance hit for sellers/shorts to cling on too. The sharp drop in relative performance against the Russell 2000 may further signify a shift in money rotation back towards more speculative stocks (and away from the S&P).

The Nasdaq looks to be following the lead of Large Caps as it steps outside of its current channel in yet another shift in acceleration. The index still enjoys good technical strength support so sellers/shorts haven't much to work with.

However, the sister index, the Nasdaq 100, could instead be offering shorts a chance to take advantage of this speculative shift in the rate of buying.

For tomorrow, continue to monitor index activity at channel resistance. Any selling which returns an index below channel resistance leaves it open to a potent 'bull trap' and could be a decent - if aggressive - shorting opportunity.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.