Daily Market Commentary: Bulls Resist Bears

It was another day where early bearish selling was unable to sustain itself into the close.

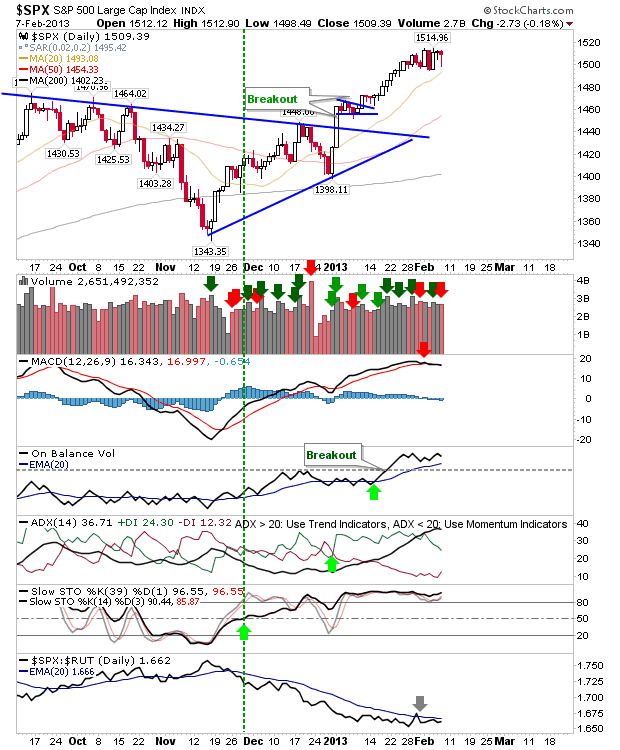

The S&P came close to a test of its 20-day MA at the intraday low. The MACD trigger 'sell' remains in play, but other technicals are firmly in the bullish camp.

The Nasdaq did manage to successfully test its 20-day MA and hold its breakout. It still hasn't adequately followed through on its gap breakout, but it's well placed to do so.

The semiconductor index has continued its relative gain against the Nasdaq. This strength should feed into the Nasdaq 100 and Nasdaq, which are lagging a little.

The Russell 2000 looks to have booked the bulk of its gains, but the past 5 days of tight action suggests it has at least one more bullish trick in its bag. However, the next gain will have its work cut out to negate the 'sell' trigger in the MACD.

Can Friday deliver a strong finish to the week. A morning gap higher would be a good start.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P came close to a test of its 20-day MA at the intraday low. The MACD trigger 'sell' remains in play, but other technicals are firmly in the bullish camp.

The Nasdaq did manage to successfully test its 20-day MA and hold its breakout. It still hasn't adequately followed through on its gap breakout, but it's well placed to do so.

The semiconductor index has continued its relative gain against the Nasdaq. This strength should feed into the Nasdaq 100 and Nasdaq, which are lagging a little.

The Russell 2000 looks to have booked the bulk of its gains, but the past 5 days of tight action suggests it has at least one more bullish trick in its bag. However, the next gain will have its work cut out to negate the 'sell' trigger in the MACD.

Can Friday deliver a strong finish to the week. A morning gap higher would be a good start.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!