Weekly Market Commentary: Bear Flags Break

The cracks which emerged on daily timeframe charts extended into the weekly charts. Adding insult to injury was the higher volume selling which accompanied these breaks. Markets are further threatened by oversold conditions which may lead to an acceleration of the declines into crashes.

The Russell 2000 is doing the leading down and the likelihood for a test of 593 over the coming weeks looks very high.

Large Caps suffered a similar fate to Small Caps, but Large Caps have underpeformed throughout 2011. Large Caps will be the last to turn - be it higher or lower - so look elsewhere for leads. The downside target for the Dow is 9,641.

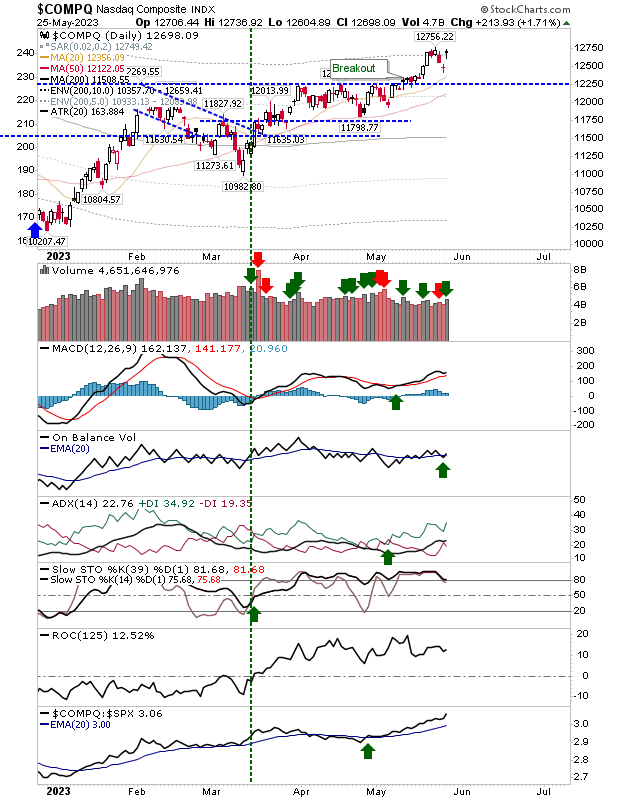

In contrast, the Nasdaq hasn't dropped out of its 'bear flag' consolidation. It also enjoys the benefit of an uptick in stochastics (momentum). While it may eventually suffer the same fate as Large and Small Caps it's likely to be the first one to recover.

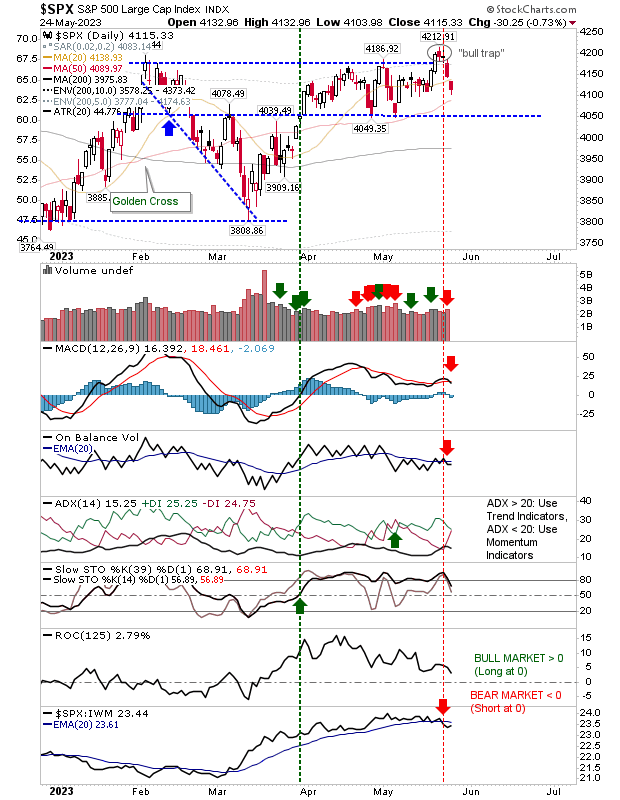

Technicals for the Percentage of S&P Stocks above the 50-day MA turned net bullish despite the losses experienced on the week. A sign of optimisim?

The S&P is (unlike the Dow) holding within what still looks to be a 'bear flag', but has seen technicals improve over the past few weeks despite the loss last week.

For next week, watch Small Caps for leads as to market direction. If markets rally then Tech stocks are likely to be the ones to do most of the leg work.

However, I suspect the downward phase still has room to run with April 2010 lows next to be tested. Early year stock buyers will no doubt continue to fret and will do so for a while longer..

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Russell 2000 is doing the leading down and the likelihood for a test of 593 over the coming weeks looks very high.

Large Caps suffered a similar fate to Small Caps, but Large Caps have underpeformed throughout 2011. Large Caps will be the last to turn - be it higher or lower - so look elsewhere for leads. The downside target for the Dow is 9,641.

In contrast, the Nasdaq hasn't dropped out of its 'bear flag' consolidation. It also enjoys the benefit of an uptick in stochastics (momentum). While it may eventually suffer the same fate as Large and Small Caps it's likely to be the first one to recover.

Technicals for the Percentage of S&P Stocks above the 50-day MA turned net bullish despite the losses experienced on the week. A sign of optimisim?

The S&P is (unlike the Dow) holding within what still looks to be a 'bear flag', but has seen technicals improve over the past few weeks despite the loss last week.

For next week, watch Small Caps for leads as to market direction. If markets rally then Tech stocks are likely to be the ones to do most of the leg work.

However, I suspect the downward phase still has room to run with April 2010 lows next to be tested. Early year stock buyers will no doubt continue to fret and will do so for a while longer..

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!