Daily Market Commentary: Rallies to Resistance

I haven't focused on the Dow as it hasn't done anything unique, but today the Dow broke declining resistance connecting reaction highs for April. Volume climbed to register an accumulation day, supporting the validity of the break.

($INDU)

via StockCharts.com

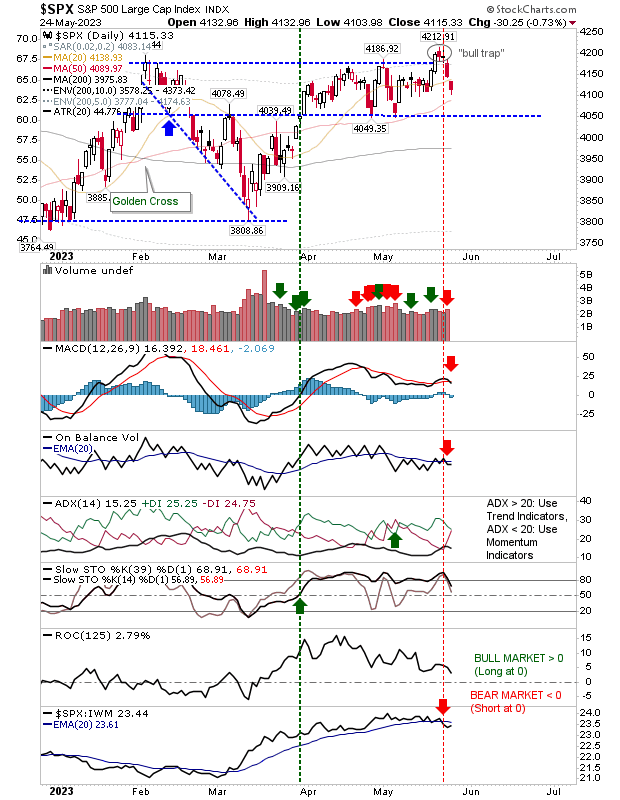

The S&P wasn't able to achieve the same success, finishing the day at declining resistance. Volume was also lighter, although it was able to close above its 50-day MA. It might be a tall ask to see a fifth day of gains, but with the Dow comfortably ahead it's not outside expectation (although unlikely).

($SPX)

via StockCharts.com

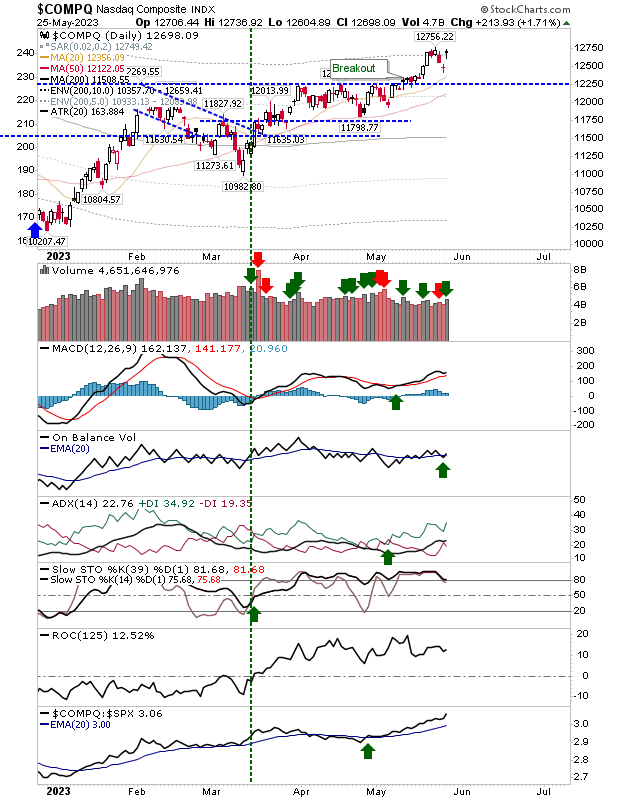

The Nasdaq was interesting. Like the S&P it finished at resistance, but unlike the S&P and the Dow, technicals turned net bullish. So while price action underperformed that of the Dow, technically it's better positioned for further gains. Volume climbed to register an accumulation day.

($COMPQ)

via StockCharts.com

It's supported by declining resistance breakouts in supporting breadth indicators, like the Percentage of Nasdaq Stocks above the 50-day MA.

($NAA50R)

via StockCharts.com

Finally, the Russell 2000 is in a similar position to the Nasdaq; finishing at resistance with technicals net bullish.

($RUT)

via StockCharts.com

For tomorrow, despite bullish technicals for the Russell 2000 and Nasdaq, look for modest losses as bulls prepare to drive a break of resistance and follow the lead of the Dow. The S&P is perhaps in the weakest position and the index most likely to show downside. The chief area lacking has been volume, this will have to increase if a break of declining resistance is to stick, irrespective of the index.

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.